To quote American businessman and author Dave Ramsey, “You must gain control over your money or the lack of it will forever control you.” Many people live in poverty, not just in developing countries but in Canada and the U.S. as well—the problem is that we don’t talk about it and we don’t do much to remedy the socio-economic inequalities in our society.

Today’s youngsters, as many parents would call us, are more open about money-related topics such as wages, the cost of living, and the price of purchases. But the stigma around personal finances persists to this day, leaving many ashamed of their economic distress and unable to bring themselves to find help.

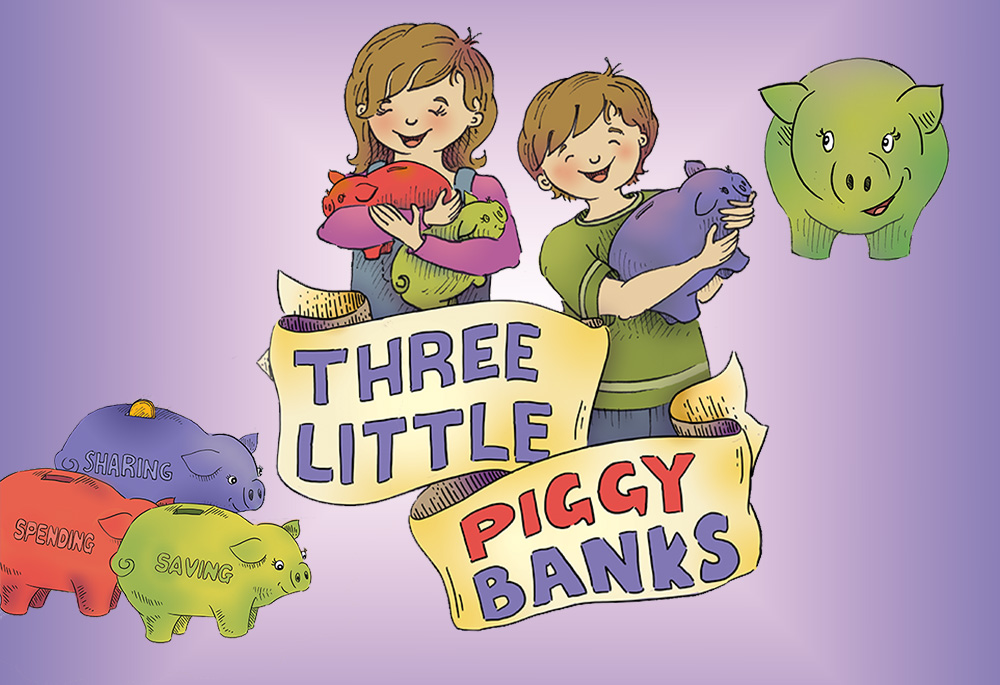

Maybe by teaching kids about money earlier, they would grow into adults who understand how to manage their money properly and who don’t shy away from discussions about personal finances, like so many adults do today. That’s what author Pamela George had in mind when she wrote Three Little Piggy Banks—equipping the next generation with the knowledge it needs to escape the cycle of poverty and the stress of never having enough money.

Adults often complain that kids these days don’t know understand budgets, mortgages, and credit cards. But how are they supposed to understand these concepts if we never teach them? This doesn’t mean children should be paying $500 in rent by the age of nine, or that their priority should be their retirement fund all throughout grade six. Three Little Piggy Banks starts small by explaining how to divide allowance into three categories: spending money, to buy things immediately; sharing money, to give to those in need; and savings, to keep aside until reaching a goal.

George’s book touches on charitable donations, living within your means, and setting reasonable objectives that you can attain. These are the first steps towards avoiding a life of late VISA payments, insurmountable debt, and financial anxiety, and even encourage compassion towards less fortunate members of society.

The world is changing rapidly—kids are having to grow up sooner and are exposed to internet scams, international news, online shopping, and all kinds of situations that previous generations did not face until they were much older. We can’t always protect our children, but we can offer them the best tools to be financially literate and live without the shackles of poverty and debt.

By teaching them to make good decisions with their allowance now, the transition to managing their income once they begin to work will be much simpler. Rather than dumping many complicated concepts on them all at once, introduce money-management strategies gradually, so that by the time they’re earning a salary, they’ll know how to live comfortably within their means and have a safe and happy life.

Key Point of Three Little Piggy Banks

- Setting long- and short-term goals

- Donating to those in need

- Tracking expenses

- Talking openly about personal finances

The book includes a worksheet to track allowance. The gift set includes the book and three plastic piggy banks.

Learn more about personal finances with this government resource.